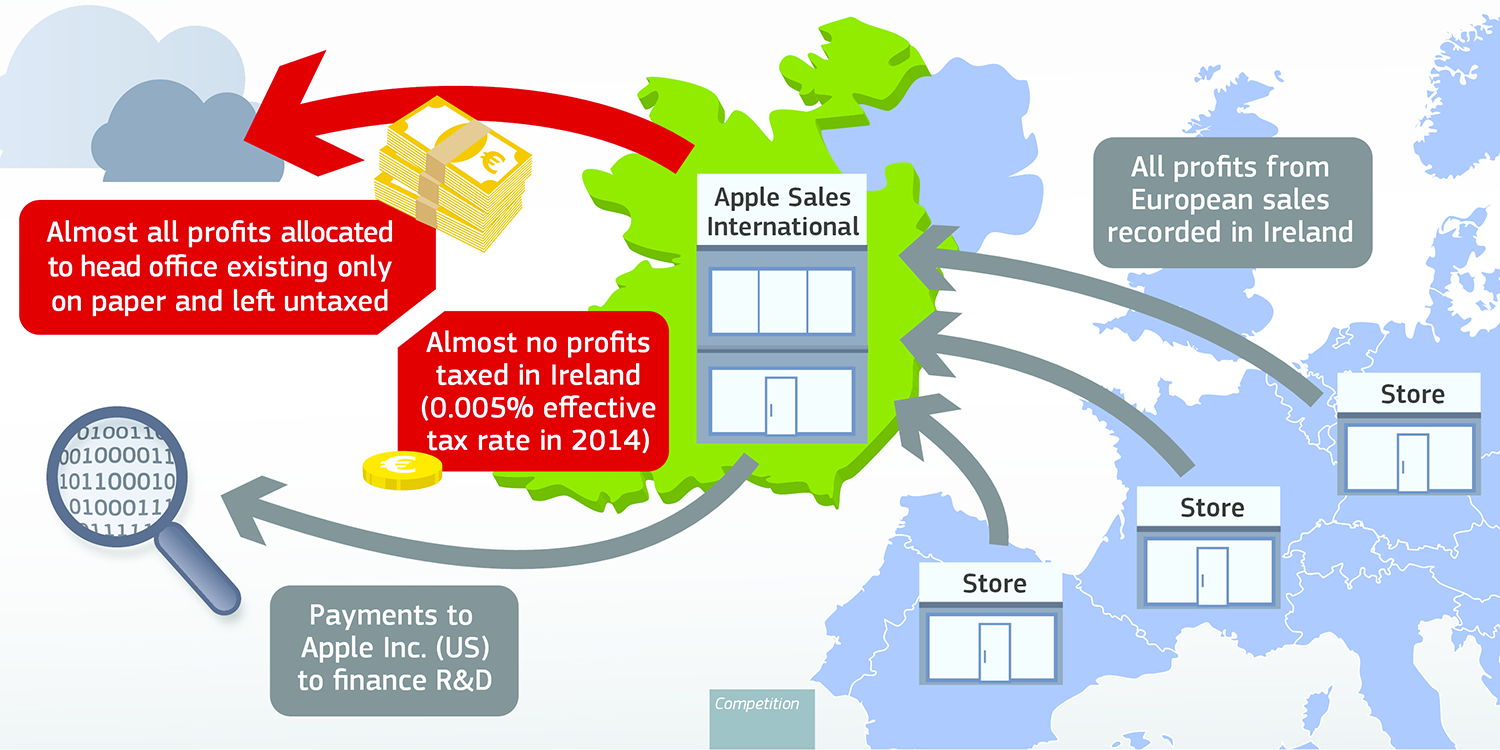

Apple, Google, Amazon among other multinational businesses could be subjected to more taxes as G7 nations reach a deal to pursue higher global taxation In 16, the European Commission ordered Apple to pay 13 billion euros ($145 billion) in back taxes to Ireland, due to Apple having received supposedly illegally low tax benefits This included aThe g7, Timor Leste 3,807 likes 5 talking about this 74 were here The g7 is an intergovernmental organisation of countries affected by

Chas Rasplaty Apple Google I Facebook Godami Uhodili Ot Nalogov Kak 130 Stran Mira Zastavyat Ih Zaplatit Milliardy Gosekonomika Ekonomika Lenta Ru

Under g7 facebook apple ireland

Under g7 facebook apple ireland- At the Facebook company, we build technologies that help people connect with friends and family, find communities, and grow businesses Post reshared from https//wwwtechmemecom BloombergUnder G7's proposed tax rules, tech giants like Facebook and Apple would still be unlikely to shift bases from Ireland, which has perks like a low 125% rate — – Irish incentives such as tax treaties continue to be a draw — Tech companies have publicly supported the G7 agreement Source

Chas Rasplaty Apple Google I Facebook Godami Uhodili Ot Nalogov Kak 130 Stran Mira Zastavyat Ih Zaplatit Milliardy Gosekonomika Ekonomika Lenta Ru

Contact Apple support by phone or chat, set up a repair, or make a Genius Bar appointment for iPhone, iPad, Mac and more Under G7's proposed tax rules, tech giants like Facebook and Apple would still be unlikely to shift bases from Ireland, which has perks like a low 125% rate (Bloomberg) Many large websites went down Tuesday, including Amazon, Twitch, BBC,China's internet regulator says any Chinese company with data for more than 1M users must undergo a security review before listing its shares overseas (Josh Horwitz/Reuters)

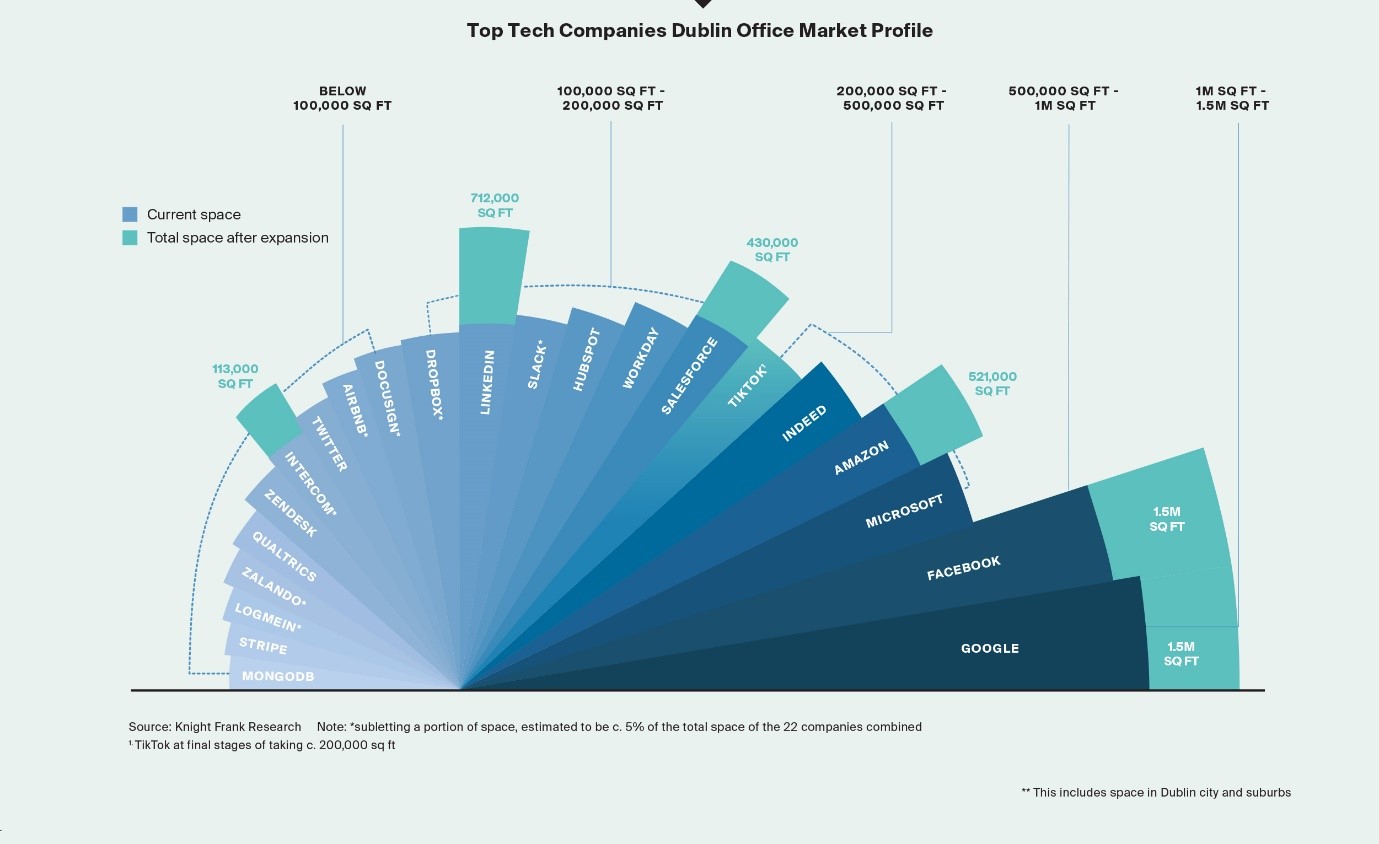

Amazon and Facebook to fall under new G7 tax rules Yellen 'Both Amazon (AMZNO) and Facebook (FBO) will fall under new proposals for a global minimum corporation tax agreed by the Group of Seven on Saturday, United States Treasury Secretary Janet Yellen said Asked whether the two companies would be covered by the proposal, Yellen said "It Big multinationals such as Apple, Facebook and Google directly employ around one in eight workers in Ireland and account for over 80% of corporation tax receipts that have boomed in recent years Donohoe reiterated that Ireland's annual corporate tax take is set to be around % or 2 billion euros lower than it otherwise would have been by Biden deals blow to Ireland with G7 corporation tax deal Apple and Facebook with its 125pc tax rate which has profit margins of below

Apple Ireland फेसबुकमा छ । Join Facebook to connect with Apple Ireland and others you may know फेसबुकले What the G7's corporate tax revolution could cost Ireland T he State has long used ultralow taxes to lure major multinationals here But as LONDON — The United States, Britain and other leading nations reached a landmark deal on Saturday to pursue higher global taxation on multinational businesses such as Google, Facebook, Apple and Amazon In a move that could raise hundreds of billions of dollars to help governments cope with the aftermath of COVID19, the Group of Seven (G7

Donohoe Confident G7 Tax Deal Will Not Dent Multinational Investment In Ireland

Us Tech Giant Shares Barely React To G7 Tax Deal The Economic Times

Opinion The latest Pfizer statement has me on the edge; In Europe, such a tax code change would be felt in Ireland, which has attracted companies such as Apple with the 125% corporation tax rate It remains unclear whether the G7 will achieve its goalSign in to iCloud to access your photos, videos, documents, notes, contacts, and more Use your Apple ID or create a new account to start using Apple services

Facebook Amazon Google React Positively To G7 Minimum Global Tax Deal

Apple News Podcasts Videos And Analysis Rfi

The G7 also said that the global minimum should apply on a countrybycountry basis – that means that it should apply to earnings in each country and multinationals would not be allowed to mix earnings from different countries for the purpose of the minimum tax If an OECD deal is agreed, Ireland will come under pressure to adopt the newView the profiles of people named Apple Ireland Join Facebook to connect with Apple Ireland and others you may know Facebook gives people the power toUnder An Irish Sky, Dublin, Ireland 255 likes 3 talking about this Photography & Videography Aerial Photography and Videography

Three Problems With The Eu S 13 Billion Ruling On Apple S Irish Taxes

G7 Summit 21 Can Multilateralism Get Us Out Of The Crises Eias

Under An Irish Sky, Dublin, Ireland 2 likes talking about this Photography & Videography Aerial Photography and VideographyApple (Ireland) Shop online and get free, contactless delivery, Specialist help and moreApple Irish is on Facebook Join Facebook to connect with Apple Irish and others you may know Facebook gives people the power to share and makes the world more open and connected

Global Minimum Corporation Tax Rate Why The Argument That It Breaches Eu Law Will Probably Fail

Chas Rasplaty Apple Google I Facebook Godami Uhodili Ot Nalogov Kak 130 Stran Mira Zastavyat Ih Zaplatit Milliardy Gosekonomika Ekonomika Lenta Ru

By Suranjali Tandon, National Institute of Public Finance and Policy, New Delhi, India For developing countries like India, the agreement reached by the G7 Finance Ministers on June 5 on proposed changes to international tax rules under "pillar one" and "pillar two" may bring little in terms of new tax revenue while imposing new restrictions on tax sovereignty LONDON (Reuters) Both Amazon and Facebook will fall under new proposals for a global minimum corporation tax agreed by the Group of Seven on Saturday, United States Treasury Secretary Janet Yellen said Asked whether the two companies would be covered by the proposal, Yellen said "It will include large G7 Nations Strike Deal to Tax Big Companies and Squeeze Havens The United States, Britain and other leading nations reached a landmark deal on Saturday to pursue higher global taxation on multinational businesses such as Google, Facebook, Apple and Amazon In a move that could raise hundreds of billions of dollars to help governments cope with

Irish Finance Minister Stands Firm On Apple Tax Deal In Budget Speech Apple The Guardian

Global Minimum Tax Still Far From Becoming Reality European Data News Hub

The 15 per cent is above the level in countries such as Ireland but below the lowest level in the G7 Amazon and Google welcomed the agreement and Facebook said it Now, the way Facebook transfers data from the EU to America is once again under threat On Thursday, the Irish High Court will hold a short BloombergUnder G7\'s proposed tax rules, tech giants like Facebook and Apple would still be unlikely to shift bases from Ireland, which has perks like a low 125% rate — Irish incentives such as tax treaties continue to be a draw — Tech companies have publicly supported the G7 agreement

New Tax Regime Won T Push Big Tech Companies Out Of Ireland Bloomberg

G7 Countries Move Closer To Tax Plan For Us Tech Giants Business The Jakarta Post

To purchase by phone, please call 1800 92 38 98 Lines are open Monday–Friday 0900–00 Find all the information you need about your Apple Online Store order To modify, track or return your order, or simply update your account info, just go to the Order status page For other enquiries, contact Apple Store Customer Service on 1800 92 38 98 Ireland has become the base of European operations for several of the largest international companies, including Google, Apple Inc and Facebook Inc The G7's minimum tax proposal aims to stop For example in 18, Facebook, which has its international HQ in Dublin, paid £285m in tax to the UK, although its revenue was £165bn However, under the G7 deal, companies could be

The G7 Might Weaponize Taxes In Hungary Daily News Hungary

Ireland Government Set To Abandon 12 5 Tax Rate Report News Dw 14 07 21

A man stabbed a Hong Kong police officer Now people are calling him a hero; Ireland's ransomware crisis continues, a Russian scammer gets sentenced, and more of the week's top security news FacebookG7 31,156 likes 165 talking about this Official page of the 21 UK Presidency of the G7 #G7UK The 21 G7 Summit will be hosted in Cornwall on 1113 June #G7Cornwall

Global Tax Deal Backed By 130 Nations Digital Journal

Digital Giants Avoided 1 5 Billion In Uk Tax In 19 Itv News

Learn what to do if youre having trouble getting back on Facebook Adjust settings, manage notifications, learn about name changes and more Fix login issues and learn how to change or reset your password Control who can see what you share and add extra protection to your account Learn how to buy and sell things on Facebook "Facebook has long called for reform of the global tax rules and we welcome the important progress made at the G7," said Nick Clegg, vice president for global affairs at Facebook Why G7 global tax deal rules out an Irish approach for independent Scotland ONCE upon a time there were six Ugly Sisters called Amazon, Google, Apple, Netflix, Facebook and Microsoft Actually, there were a few more that people were less acquainted with or had forgotten about, such as Dell, IBM, Intel, Cisco and HP

France Says Crazy That Apple And Others Get Permanent Tax Haven Status 9to5mac

Nearly 26m Amazon Facebook Apple Ebay User Logins Stolen Panatimes

Apple Google Amazon And Other Tech Giants May Have To Pay Much Higher Taxes As G7 Countries Reach Breakthrough Deals Fuentitech

G7 Nations Strike Deal To Tax Big Companies And Squeeze Havens

G7 Countries Move Closer To 15 Corporation Tax Plan As Finance Minister Defends Ireland S 12 5 Rate

Apple Faces Higher Taxes After G7 Agree To Global Tax Rate Changes Appleinsider

Why G7 Global Tax Deal Rules Out An Irish Approach For Independent Scotland The National

G7 Teaches Tech Giants A Taxing Lesson In Corporate Social Responsibility Newsroom

Global G7 Deal May Let Amazon Off Hook On Tax Say Experts Amazon The Guardian

G7 Countries Move Closer To Tax Plan For Us Tech Giants

Ireland Pushes For Compromise On Minimum Global Corporate Tax Appleinsider

Historic G7 Deal To Stop Global Corporate Tax Avoidance Welcomed By Tech Giants Google And Facebook Uk News Sky News

Facebook Faces Scepticism After Welcoming G7 Global Tax Rule Reforms

Irish Watchdog Fines Twitter In Landmark For Eu Data Privacy Regime News Medias

Google Apple Microsoft Hqs In Ireland Lead 15 Tax Debate Reports

G7 Deal Will Likely Raise Taxes For Tech Giants Like Apple And Google Engadget

Tax Paid By Apple Google And Others To Rise Ireland Unhappy 9to5mac

Facebook V Apple The Ad Tracking Row Heats Up c News

Bargaining Over Global Tax Enters Key Stage Ihub Partner Press Releases International News

G7 Rich Nations Back Deal To Tax Multinationals c News

Ireland On Brink G7 Tax Plan Threatens Major Exodus Of Tech Giants In Dublin World News Moradabad News Moradabad Business

Us Judge Dismisses Antitrust Lawsuits Against Facebook Financial Times

Facebook Amazon Google React Positively To G7 Minimum Global Tax Deal

G 7 Nations Reach Historic Deal To Tax Big Multinationals Voice Of America English

The European Institute For International Law And International Relations

Chas Rasplaty Apple Google I Facebook Godami Uhodili Ot Nalogov Kak 130 Stran Mira Zastavyat Ih Zaplatit Milliardy Gosekonomika Ekonomika Lenta Ru

New Tax Regime Won T Push Big Tech Companies Out Of Ireland Bloomberg

The G7 Paved The Way The Ball Now In The Oecd And The G

G7 Summmit Landmark Tax Deal To Target Google Amazon Facebook

Chas Rasplaty Apple Google I Facebook Godami Uhodili Ot Nalogov Kak 130 Stran Mira Zastavyat Ih Zaplatit Milliardy Gosekonomika Ekonomika Lenta Ru

Apple List Shows European Suppliers In

What Is This World Tax On Multinational Companies Backed By Joe Biden

Fairer Taxes On Big Tech Could Cover Cost To Vaccinate Entire Planet Business Economy And Finance News From A German Perspective Dw 05 21

G7 Countries Move Closer To Tax Plan For Us Tech Giants The Economic Times

Historic G7 Deal To Stop Global Corporate Tax Avoidance Welcomed By Tech Giants Google And Facebook Uk News Sky News

Varadkar Says High Irish Tax Rates Are A Problem Is He Correct

Ireland Confident G7 Tax Deal Won T Dent Multinational Investment Reuters

Ireland Plays Defense As Overhaul To Global Corporate Tax Rate Looms Appleinsider

Eu Hails G7 Tax Agreement But Internal Divisions Could Thwart Consensus Euronews

Facebook Says It Could Pay More Tax After G7 Deal Euronews

Chas Rasplaty Apple Google I Facebook Godami Uhodili Ot Nalogov Kak 130 Stran Mira Zastavyat Ih Zaplatit Milliardy Gosekonomika Ekonomika Lenta Ru

G7 Leaders Vow To End Race To Bottom On Taxes World News Wionews Com

The Us Has Reportedly Pushed The Eu To Delay Its New Digital Services Tax Euronews

A G7 Deal On A Global Minimum Tax For Companies Faces Hurdles

/cdn.vox-cdn.com/uploads/chorus_asset/file/11105269/acastro_180522_facebook_0001.jpg)

Facebook Expects Ad Tracking Problems From Regulators And Apple The Verge

Deal On Minimum Global Corporate Tax Reached With Caveats

Ireland On Brink G7 Tax Plan Threatens Major Exodus Of Tech Giants In Dublin World News Express Co Uk

Digital Brief Powered By Facebook Microtargeting Debate Protecting Gig Workers Apple Antitrust Euractiv Com

Cambodian Newspaper Publisher Arrested Over Facebook Posts International Press Institute

Facebook V Apple The Ad Tracking Row Heats Up c News

Fate Of Ireland S Tech Boom Is About More Than Tax

G7 Tech Tax Deal Won T Do Much For Hard Pressed Retailers Opinion Retail Week

G7 Strikes Historic Agreement On Taxing Multinationals Financial Times

Apple News Podcasts Videos And Analysis Rfi

Irishcentral Com Home Facebook

Top 1000 21 Apple Remains Ireland S Largest Company

C91t8jjv Xw2pm

Ireland S Days As A Tax Haven May Be Ending But Not Without A Fight Gm Newshub

Facebook Photo Transfer Tool Launched In Us And Canada

As Us Tech Giants React With Fury What Does The G7 Deal Mean For France S Gafa Tax The Local

G7 Backs Global Corporate Tax In First Step Towards Reform Economist Intelligence Unit

Ireland S Low Tax Economy Can Survive Oecd Reform Experts

Will A Global Minimum Corporate Tax Rate Affect Fdi Investment Monitor

Apple Google Amazon Other Tech Giants May Have To Pay Higher Taxes As G7 Nations Reach Landmark Deal

Lkt74z W2aaium

Facebook S Remote Work Move Means Floodgates Have Opened

Global Tax Deal Backed By 130 Nations Ireland And Hungary Stay Out Euractiv Com

Investing In Big Tech Ranking The Tech Giants Climate Commitments Clim8 Invest The 1 App For Sustainable Investing

Global Corporate Tax Revamp Deal Set For G7 Meet Momentum Bloomberg

France Defiant On Plans To Impose Gafa Tax On Tech Giants

G7 Tax Accord Is Big Step Towards Fairer World

New Tax Regime Won T Push Big Tech Firms Out Of Ireland Ht Tech

Ireland Faces G7 Tax Impact As One In Eight Jobs Can Be Fired The World News Algulf

Apple List Shows European Suppliers In

Buy Givi S957b Gps Uni Bag Normal Smartphones Louis Motorcycle Clothing And Technology

How Apple Got Its 2 Tax Rate In Ireland Quartz

Landmark G7 Agreement Tokyo Olympics In Peril By International Intrigue International Intrigue

The Irish Regulator Could Continue The Investigation On Facebook

G7 Tax Plan Tech Giants Like Apple Facebook Google May Have To Pay Tax In India Business News

World S Richest Face Tax Squeeze After 40 Boost To Fortunes The Japan Times

Apple Dodges 15b Tax Bill In Eu Court Appeal Icij

North Western District Methodist Church In Ireland Posts Facebook

Global Agreement Could Force Tech Giants And Other Multinationals To Pay Australia Up To 5 7bn In Tax Tax The Guardian

Biden Deals Blow To Ireland With G7 Corporation Tax Deal Sports Grind Entertainment

0 件のコメント:

コメントを投稿